SEA Tech Thriving During Covid

Covid, Entrepreneurship, Startups, Valuations, Founders, Talent, Deals & Exits!

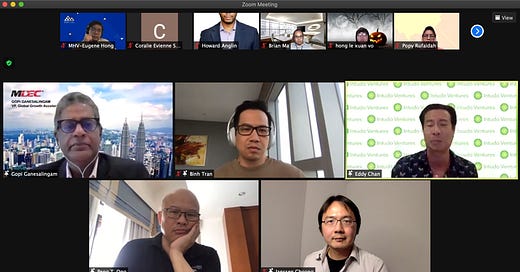

Horizon Connect recently gathered a panel of VC’s (Binh of 500s Vietnam, Eddy of Intudo Ventures & Peng of Monk’s Hill Ventures) together with MDEC’s Gopi for a discussion on the state of SEA Tech as it thrives even during Covid. Some notes below:

[SEA & Covid]

Covid accelerates traditional transformation. With recessions, increasing efficiency is critical to survival and tech is typically involved. A lot of tech helps in social distancing, making it easier to adhere to isolation rules for quarantines (eg. communication in healthcare) and thus magnifies adoption.

Pre-Covid, Vietnam was one of the top 3 performing countries in SEA. During Covid, likely the #1 in region.

In Indonesia, pre-Covid, conglomerates saw tech as a ‘nice to have’ but Covid has made it a ‘must have’ and this has increased engagement & partnerships with startups across the board.

Covid response in SEA is better than the West so SEA is positioned to recover faster.

[Entrepreneurship]

In Vietnam, entrepreneurship is a necessity. 97% of enterprises in Vietnam are SME’s, ex. 1.4m FMCG retailers and entrepreneurship is part of the culture.

Regionally, tech entrepreneurship is relatively new but growing rapidly. ~15 co’s w. valuations > 25m in 2016, now 70-80 w. more local heroes

[ Startups & Covid ]

Of the 2-4 good companies per business model per sector, it is not unreasonable to see 1 or 2 die off because of how they constructed their teams or cap tables

“Forest Gump” moment for startups now. For those that survive, they will be victors with all the shrimp.

[ Founders & Talent ]

Downturn has been good for the ecosystem with less ‘fake founders’ and stronger teams forming up

Talent more accessible as smaller (but well-funded) startups are able to face-off against the larger unicorns in the talent wars

Regionally, 41 of 67 founders with companies w. valuation in excess of 100m are returnees. In terms of companies, 90% has a founding team member from abroad

[Valuations]

Most valuable SEA company now is a tech company. SEA Group.

Valuations are generally lower SEA because risks are higher (regulatory, geo, talent/hiring, less predictable)

Valuations had an uptick last 2-3 years but with Covid, valuations have tapered off. 20-30% drops in valuation have been seen post-Covid.

Founders are now more mature/disciplined. With Covid, raising for longer runways extending from the 15-24 months to the 18-30 months marks. Consequently dilutions have moved from 20-30% closer to 25-35%

[Deals]

[MHV] Seeing twice as many deals this year (vs the last). Looking for real estate play.

[500s] 11 deals in the last quarter, 7 were new. Busiest quarter ever. Looking for SME lending at scale.

[Intudo] Boots on the ground needed. With Covid, lead deals where regionals couldn’t fly in. Looking for founders with global experience (looking or ) returning to Indonesia.

CVC’s are mostly focusing on core business w. moratoriums on new deals. This allows for independent funds to thrive.

[Exits]

Exits take time & patience needed to see the larger exits come into play. IPO’s need 100m in revenue to get to Nasdaq and there aren’t that many companies at that level in SEA

SPAC’s: Bridgetown Holdings (Thiel, Richard Li) priced a $575m SPAC in Oct focused specifically on acquiring a company in SEA which puts it in a position to acquire a company up to the B range.

Seeing some exists in secondaries > 50m in valuation.

As a nascent market, Vietnam is still maturing but signals are there for exits to come. Seeing excitement for secondaries + fund secondaries.

About Horizon Connect: https://www.horizonconnect.com/

We are work with various organizations acrosss the Pacific providing key talent & advisory within the tech sector.